In 2023, the U.S. Small Business Administration finalized rules to allow new models for its Small Business Investment Company (SBIC) financing vehicle: Accrual and Reinvestor licenses. As I wrote at the time, these rules make the program a better fit for early-stage investment than it has been for the past 20 years. From new data released by SBA for FY 2024, the accrual license is off to a modest, but important, start.

SBIC activity in FY 2024

This is a summary of SBA’s data on Accrual SBICs in FY 2024:

| Funds operating | 3 |

| Private capital commitments | $220.0 million |

| Funded commitments | $22.7 million |

| SBA capital commitments | $79.9 million |

| SBA leverage outstanding | $17.2 million |

| Companies financed | 5 |

| Financing amount (all equity) | $19.7 million |

Accrual SBIC size

Three funds with $220 million in private capital commitments and another $80 million in committed SBA leverage is a solid start to the Accrual license. The fundraising outcome seems particularly reasonable considering that the total venture capital market saw a third straight year of declining capital commitments to funds (and half of all funds raised were secured by just nine firms).

However, the average fund size of $100 million average for the Accrual licensees is, perhaps counter-intuitively, a bit disappointing. SBIC’s new rules allow funds to have as little as $3 million in private capital. SBA’s data is aggregate, and so at least one licensee may be small, but the average places these SBICs into the upper third of operating venture capital funds and far greater than the median 2024 venture capital fund raise of $24 million (per PitchBook data).

Fund size is interesting in large part because of what it suggests about Accrual SBICs’ relevance to the capital needs of the earliest stage companies. While size is not entirely indicative of investment strategy,[1] operational realities tend to dictate that larger funds will make larger investments. With private venture capital markets continuing to scale fund sizes (while the median raise in 2024 was $24, the average was $169 million—a new record) and investment deals toward the higher end of the spectrum and time between rounds increasing, there is greater pressure on new companies to secure initial capital.

Ideally, Accrual SBICs can be part of the solution for new, high-growth companies, but this may be more realistic if licensed funds are smaller. To help the field better understand what role the program is playing in the risk capital markets, SBA could start providing metrics of company financings by deal size.

Mix of SBIC types

Unsurprisingly for a new category, Accrual licensees are a drop in the overall SBIC bucket. In FY 2024, there were 258 SBICs using the semi-annual debenture and another 52 licensed but not using SBA capital. No Reinvestor licenses were approved in FY 2024.[2]

Accrual licenses are well behind in other metrics as well: the semi-annual debenture SBICs had $41.6 billion in capital (including SBA leverage) and provided $6.9 billion in financing to 1,014 companies. Again, this is in line with a new program that only licensed its first few funds during the year.

The small share of Accrual SBICs to the overall program is reminiscent of the Community Development Financial Institution (CDFI) field, which allows CDFIs to organize as venture capital funds but only 13 of 1,414 current funds have done so. However, the option to seek CDFI certification as a venture capital fund has been permissible for a long time, and so there could be a more even distribution of SBIC fund types in the future as firms pick up the new Accrual or Reinvestor licenses. The rate of pickup in the program is another factor to monitor going forward.

Application activity

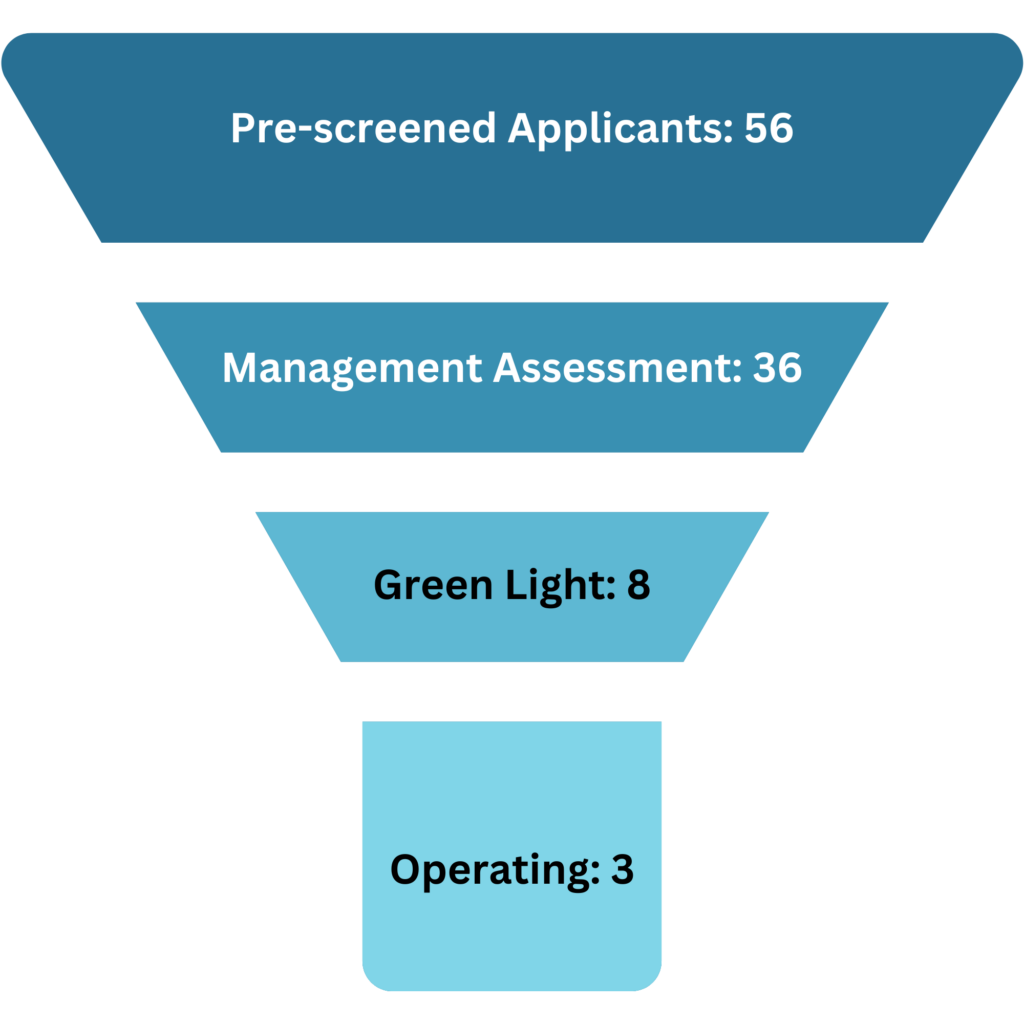

The SBA data indicate a larger funnel of potential Accrual SBICs.

Figure 1. Accrual SBIC applicants by approval stage, FY 2024.

This seems to be a good, initial level of serious interest in the program. While the pre-screen application could be exploratory in nature, submitting a management assessment questionnaire has a fee of at least $5,000 (depending on the number of prior approved funds). SBA does not clarify how many companies are continuing to work through the application process and how many have been discouraged (or halted for other reasons). Still, at least an additional five companies likely are in the process of raising fund commitments to begin operations in FY 2025.

While no Reinvestor SBICs made it to the operating status in FY 2024, eight applied and were pre-screened, seven submitted a management assessment questionnaire, and two received green light approval.

Significance of new rules

The Accrual license makes it easier for SBICs with a venture capital investment strategy to receive capital from SBA. Since 2004, venture capital funds were eligible for the SBIC program but could only tap SBA funds if they could make semi-annual payments, and so it was difficult to execute in practice. The Accrual license allows SBICs to pay SBA back either at the end of the 10-year loan or when an investment results in a distribution to the fund’s partners. This better-matches a venture capital fund strategy and so makes it easier for these funds to tap into SBA’s capital and expand their total assets and availability to small businesses.

The Reinvestor license allows an SBIC to invest in other funds, a strategy that was not allowed by prior program rules. Further, these licenses can also utilize the Accrual repayment structure. Taken together, the Reinvestor license facilities a fund-of-funds investment strategy for SBICs that is supported with SBA capital.

New SBIC licenses are interesting to the extent that they can help balance purely private activity. Venture capital continues to be the private markets’ preferred vehicle to provide capital to new and growing technology companies. Unfortunately, this money also continues to be heavily concreted in a few cities—PitchBook shows 50% of deals and 72% of capital in 2024 was invested in just four combined statistical areas—and generally only available for male founders (less than 6% of companies receiving investment in 2024 had an all-female team).

SBIC, along with CDFIs, the U.S. Department of the Treasury’s State Small Business Credit Initiative, and state-, local-, and nonprofit-backed sources of capital should all be able to act as counterweights to private biases and support economic development objectives alongside (or instead of) financial goals. SBIC is not a perfect vehicle for addressing non-financial concerns, as requirements that SBIC licensees demonstrate a potential for market-rate returns limit their ability to behave too much outside of the norm, but the program does have a statutory preference for supporting funds in under-represented states.

Takeaways for regional economies

Here are three points for regional policymakers and practitioners to consider from this first set of Accural SBIC data:

- SBA had a solid level of initial interest in the Accrual license (i.e., 36 firms paying the $5,000 application fee), so this vehicle merits further attention.

- Approved Accrual licensees averaging $100 million funds suggest investment strategies that will be after the seed or angel investment stage for many companies.

- If this licensing trend continues, Accrual SBICs will be better partners as follow on investors for the many regional risk capital access strategies that focus on pre-seed, seed, and angel capital.

To learn more about the new SBIC licenses and how they may be applicable to your region’s innovation economy, contact us to schedule a 1:1 conversation.

[1] What really matters is the funds’ actual investment strategies. For example, a $100 million fund reserving 50% of its capital for follow-on investment and charging a 2% management fee may be looking to make initial investments of $1.5 million.

[2] An interesting historical note: the last operating Participating Security SBICs, a license type discontinued in 2004, dropped off in FY 2024.